Please click and read this disclaimer if you wish to continue with the contents below.

For my previous portfolio review click

here

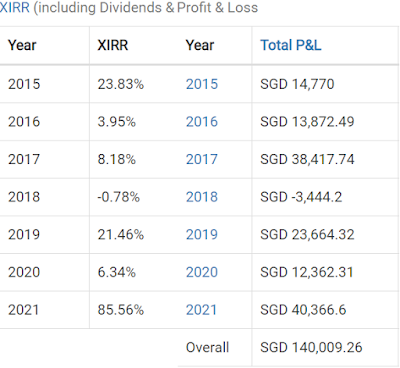

YTD(2021) I have made a total profit of S$40,366.60 from my equity

investments(predominantly in HK) with an XIRR of 85.56%(XIRR is annualized).

From my 6 years of tracking, I have made a total of S$140,009.26 from

this portfolio alone.

In terms of benchmarking with STI, HKSE and World index. There was a

substantial pullback recently due to inflation and interest rate worries. The

large difference between my XIRR and TWR is due to XIRR being annualized in

nature and the price appreciation of some of my stocks recently.

Portfolio composition(4 index etfs and 26 stocks):

Transactions:

Sold all Haw Par(SG:H02) at 35% gain

Sold all Great Eastern(SG:G07) at 21% gain

Sold all Swire Properties(HK:1972) at 13% gain

Initiated a 2.35% position in Xinyi Energy(HK:3868)

Initiated a 2.67% position in ZA Online(HK:6060)

Bought back JXR(HK:1951) to 3.46%

Added more Kingsoft(HK:3888) to 5.34%

Added more C-MER(HK:3309) to 3.98%

Added more GDS(HK:9698) to 4.48%

Added more Vobile(HK:3738) to 6.32%

Commentary:

Market is currently unkind towards Chinese innovation. As US prints more

than 25% of their total USD float to sustain their recovery(haven't include

infra bill and stimulus), bond traders are pricing in an accelerated

inflationary scenario. I feel, there are numerous argument against this.

Asset inflation is true, due to low rates, property prices will go up. This

kind of inflation is temporary as more builders in the US will come in the

equalize it. Hence I feel asset inflation which result in commodity

inflation(steel, cement etc) are short term spikes. Capitalism will

normalize this.

While the eurozone is still at negative interest rates, US treasury yield

will have a cap due to arbitrage. This can result in a short squeeze in the

bond market. Technology innovation is another deflationary force. Ecommerce

has brought down the price of groceries and daily necessities. EV prices are

going down due to cheaper batteries overtime. Dvds and entertainment cost

are going down drastically due to direct to consumer channels like Netflix

and Disney+. Intense competition will also cause factories to take losses

instead of hiking prices too much to drive away customers. Mobile data subscription cost is

going down due to intense competition from telcos and government policies. Despite the excessive printing by the Fed, there is a high chance that inflation will still be in control.

Hence I feel the current strategy is to buy the dip for tech and not to swap

to recoveries as much. I might be wrong but that's what I think.

Xinyi Energy(HK:3868) owns and operate 16 large scale solar

farms with an approved capacity of 1514 megawatts. They have never had a

power limit in the history of operation. Renewable clean energy is currently

being pushed and supported by China.

|

| One of Xinyi Energy's solar farm |

Short-term positive factors such as the expected earnings rebound of 47%

this year under the normalization of sunlight resources. In the long term,

the company's production capacity is expected to grow at a compound annual

growth rate of 34% from 2020 to 2023, and 62% of the company's solar farms

will achieve market price by 2023, so the company's cash flow will not be

affected by the subsidy policy. At the same time, the company has a strong

balance sheet and a high increasing dividend yield.

ZA Online(HK:6060) ZA Online's road to subvert the traditional

insurance industry has been laid at the beginning of the company's

establishment in 2013. The unique Internet gene made the company different.

It is the only Insuretech that has joint stake by three giants:

Tencent(10.56%), Ant(14%) and Pingan(10.56%).

ZhongAn's online business is mainly divided into two categories. One is the

online insurance business empowered by Internet technology. Divided into

four major ecosystems: Healthy ecology(Enjoy e-life), Digital life

ecology(Return freight insurance), Consumer financial ecology(Guarantee

insurance), Car ecology(Car insurance)(Main insurance products in brackets).

Different from traditional insurance companies, ZhongAn Online does not have

offline outlets. About half of the employees are engineers and technicians.

Technology and Internet genes are ZhongAn’s first technological moat. Rely

on technology, the company's business can scale rapidly in the Internet era

and maintain rapid growth. Without offline outlets and with much lesser

staff, their margins alone are already very disruptive towards traditional

insurers.

Last year, it has about 524 million insured users of ZhongAn Online

Services. Over 7.9 billion total insurance policies. One out of every six

insurance policies in the country comes from ZhongAn. ZhongAn Online broke

the top ten ranking in the property insurance industry in China. Became the

ninth largest property insurance company in the country. Its app is also one

of the highest rated among online insurers.

ZhongAn's rapid growth is not blinding, but high quality. The company has

verified the business model of Internet insurance by taking the lead in

profitability among global peers. Technology is the key to profitability.

Valuation wise its cheap. It can be seen from the table above. ZhongAn

Online's 2020 sales is 23-3x of these three US online insurers. It is also

the only one that has reached profitability. But the market value these

three loss-making insurtech companies equivalent to 56.84%, 56.86% and

32.95% of ZhongAn respectively. The Price to sales ratio multiples also far

exceeded ZhongAn(example Lemonade price to sale is 54.3x vs ZhongAn's

4.19x).

Will go deeper into these counters later on.

ReplyDeleteAre you willing to know who your spouse really is, if your spouse is cheating just contact cybergoldenhacker he is good at hacking into cell phones,changing school grades and many more this great hacker has also worked for me and i got results of spouse whats-app messages,call logs, text messages, viber,kik, Facebook, emails. deleted text messages and many more this hacker is very fast cheap and affordable he has never disappointed me for once contact him if you have any form of hacking problem am sure he will help you THANK YOU.

contact: cybergoldenhacker at gmail dot com