Please click and read this disclaimer if you wish to continue with the contents below.

For my previous portfolio review click here

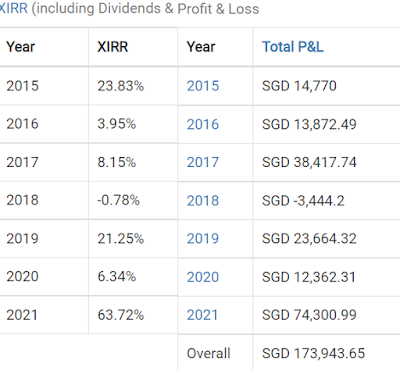

YTD(2021) I have made a total profit of S$74,300.99 from my equity investments(predominantly in HK) with an XIRR of 63.72%(XIRR is annualized). From my 6 years of tracking, I have made a total of S$173,943.65 from this portfolio alone.

Portfolio composition(2 index etfs and 28 stocks):

Transactions:

Sold all Emperor E Hotel(HK:0296) for 6.35% profit

Sold a little C-MER EYE(HK:3309) for 91.66% profit

Added more Haidilao(HK:6862) to 3.07% of port

Added more Kingsoft(HK:3888) to 4.62% of port

Added more China Youzan(HK:8083) to 4.69% of port

Commentary:

Emperor E Hotel(HK:0296): Sold all my position in Emperor E Hotel after they announced that they are going to spent 2.083billion hkd to acquire hotel assets from their parent company. Not very comfortable with these kinds of arrangement especially with a cross held conglomerate like Emperor. This 'acquisition' will almost completely wipe out most of its cash in its balance sheet.

C-MER EYE(HK:3309): Sold 12% of C-MER today at 91.66% profit to rebalance my portfolio as I do not want it to be heavier weighted than Vobile. Talked alot about C-MER in the past and my rationale for holding it even though it has risen almost 100% still persist. Used the proceeds to buy more Kingsoft, Haidilao and China Youzan.

With China's new three child policy and a rapidly ageing population, specialized healthcare like ophthalmology and ivf will likely continue to reap the tail wind effect.

Haidilao(HK:6862): I expect Haidilao to continue to be brutally destroyed by the market because near term dine in will be impacted by the delta variant virus globally. Its share price has tanked 60% from the peak. However in terms of recovery play, Haidilao in my view has the most potential. That is why I have initiated a position recently.

Haidilao is comparable to Mcdonalds. Firstly, it has the ability to scale rapidly because its a hotpot business with a strong ingredient distributor(Yihai). The ingredients and broth are streamlined and churned out using robots and machines. No chef is needed as customer cook their own meat. It is currently still the biggest hot pot chain in China.

Its property rental expense is also only 1% of their total revenue. Ie the bulk of the expense goes to its staff and ingredients. This company has a very unique work culture. The founder insisted that HDL's internal job mobility to be fluid, ie as long as you can perform well, you have the potential to get promoted and ultimately head a restaurant and get share compensation. That is why the greatest moat of Haidilao is its extreme service. No other restaurant in the world is able to replicate this.

Although it is expanding globally, its main concentration is still in China. Current predicament is due to expanding too fast and not strategically, causing table turnover rate to drop. It takes 4-5 months for a restaurant like theirs to break even, that is why their recent profit took a dive. Covid also played a role in that.

Current valuation is around 6x price to sale, 33bil sgd market cap compared to Mcdonald's 233bil. That is if you believe that HDL will ultimately be a truly global hot pot chain. If the founder is able to continue to maintain the company's service standard, despite its rapid expansion globally, I think a normalized 22% rote is very doable. Own view.

Hi everyone, My name is Jennifer from New Jersey , I saw comments from people who had already got their loan from Anderson Loan Finance. Honestly, I thought it was a scam, and then I decided to make a request based on their recommendations. A few days ago, I confirmed in my personal bank account amounting to $15,000 dollars which I applied for. This is really a good news and I am so very happy that I advise all those who need a real loan and who are sure to reimburse to apply through their email (text or call) +1 719 629 0982. There are sincere loan lenders! They are capable to lend you a loan. Contact Mr Anderson E-mail: andersonraymondloanfinance@gmail.com

ReplyDeletePhone: +1 719 629 0982

E-mail: andersonraymondloanfinance@gmail.com

Office address is (68 Fremont Ave Penrose CO, 812400).