My criteria for best savings account is primary based on two factors: interest rate, and how easy it is to meet the requirements. In a cash rich situation, putting money into your savings account gives you an added advantage as compared to being locked up in a fixed deposit. Your cash gets the monthly interest and you can still move the money out anytime when opportunity strikes. These three choices of mine, can be used together if you wish to be temporarily out from the equity/bond market.

2) CIMB Starsaver savings account gives 0.8% per annum with very easy to meet requirements. Basically you just need to deposit at least $1000 from the start and make sure the principal amount increases by $100 every month. If you put in $50,000 for example, it will automatically separate the total amount to packets of $100 increment each month, which gives you 0.8% interest for the whole $50,000 for many months to come. As it is capped at $750,000, it enables compounding. Which makes it a good candidate for putting interest earned from OCBC360 and DBS multiplier into it if both are capped. The easy to meet requirement, high capped amount and reasonable interest at 0.8% makes this my second best choice.

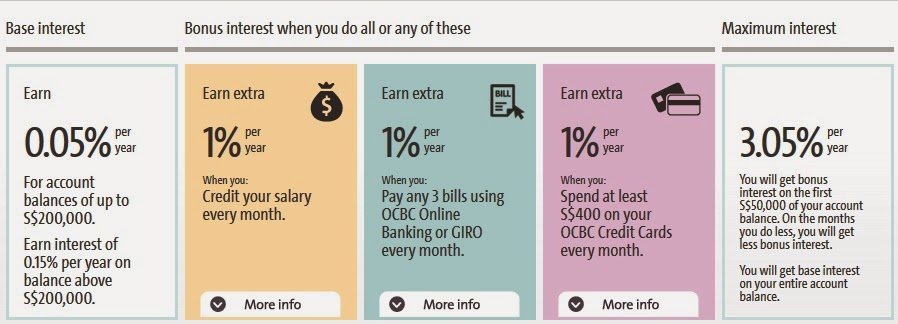

1) The best savings account for 2014 definitely goes to OCBC 360 for its highest interest earned(3.05%) and easy to meet requirements. Its interest is better then most SGS and short term rated corporate bonds out there. The requirements of paying three bills, crediting your salary and spending $400 on credit card are pretty easy requirements to meet. It is capped at $50,000 so this should be the first account one should max out(if you can meet at least two of the three requirements).

No comments :

Post a Comment