The weather man never fails to give the most politically correct answers to all questions in life.

S chips

Please read the disclaimer at the bottom of my blog if you wish to continue with the contents below.

S-chips seems to have made a bad name for themselves these past few years. A number of them have been caught with being less truthful.

How can one justify the validity of the fundamentals of S-chips now? Maybe there are some signs that we can look out for. For example, look out for companies with excessive cash or debt. Be cautious of S-chips that shows large cash reserves, but refuses to pay dividends and in turn calls for right issues.

I doubt these signs can be fool proof though. The best way to prevent being caught is to avoid them altogether. To each his own.

Is the Stock Market Random?

I remember reading an interesting discussion about this quite sometime ago. Is the Stock Market completely random(filled with uncertainty that is impossible to measure), fully deterministic(filled with uncertainty that can be ultimately measured) or a mix of both?

When I say "deterministic", I mean that it is possible to predict this component with certainty, from historical precedent. Like if we can measure all the forces and momentum surrounding a dice being rolled, we can consistently know its value. So a dice being rolled in that context, isn't random but fully deterministic.

It is illogical to think that every possible future is equally likely. Some future are more likely than others. We all accept that the movement of the markets isn't predictable with extreme accuracy, just like the weather forecast. There will always be a varying degree of uncertainty in it.

Technical Analysis is an extraction of predictable components. For random short term components, there's the RSI or MACD, For deterministic components, there is long term moving averages. However, random components also depend upon so many things that we cannot know at that time.

If science ultimately concludes that our universe is fully deterministic(with all the initial conditions, at hand we can know exactly what is going to happen at time t), then the concept of a free market will cease to exist. What do you think?

My thoughts on budgeting, income and expenses

Please read the disclaimer at the bottom of my blog if you wish to continue with the contents below.

I am penning down my current way of doing family budgeting, so as to compare how differently it would evolve 10 years from now.

I personally like to stick to two very basic general pointers: income and expenses.

1) Income can come from many sources, be it my work, rentals(optional), room rentals(optional), total fix dividend payout from stocks, fix deposits, bonds and interest from savings. I also include my spouse income and other more variable sources of income like year end bonuses(if it is guaranteed). Once finalized, I would try to get an accurate number of an average net income(after taxes) per month.

2) I categorize expenses into two groups.

First group of expenses are the predictable ones which rarely change, like insurance, utilities, levies, housing loans etc.

Second group of expenses like, food, transport, clothing are more variable and so I try to put a close estimated value to each of them. I put large, infrequent expenses like house repairs, car, computers etc in this group too.

3) Once I am done with that, I compare them and make sure they are at least equalized. If my expenses are more than my income, I would take action to stream line my second group of expenses.

I try to strife for a comfortable 10% or more income surplus to my expenses so that I can put that extra into savings. Once the amount of savings is deemed enough for another potential income vehicle, I would compound it back, in hopes of increasing my income.

Of course, both pointers cannot be put to the extreme, as my main goal ultimately is to have a comfortable life with my loved ones. Find the "Goldilocks zone" that is right for you.

Happy Birthday to myself.

Happy Birthday to myself! Another year older and hopefully another reason to celebrate life. Oprah Winfrey used to say that, "The more you praise and celebrate your life, the more there is in life to celebrate".

Dow -185.46

Please read the disclaimer at the bottom of my blog if you wish to continue with the contents below.

I have always agreed to the saying that, the stock market is what the masses make out to be. Despite the euphoric enthusiasm in the wake of the Fed's decision not to taper down on its bond buying program, mass market sentiments was directed to political confrontation over Obamacare and the federal budget as the logical reasons to reverse course.

Of course one can assume that the temporary foregoing of this tapering could mean the US economy is still in doldrums. Hence for me personally, I dont put too much faith in "news". They can change as an when they want to.

In this new age of volatility, I also tell my friends to exit on the basis of profit and not price potential. If the profit is enough for you, take it. If its not quite enough but the stock price has appreciated too fast, take half of it. Thats my philosophy in trading, as Mr Market has no emotions.

In this new age of volatility, I also tell my friends to exit on the basis of profit and not price potential. If the profit is enough for you, take it. If its not quite enough but the stock price has appreciated too fast, take half of it. Thats my philosophy in trading, as Mr Market has no emotions.

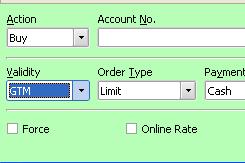

The Usefulness of Good Till Date(GTD) and Good Till Maximum(GTM)

SGX and MAS have recently approved the use of GTM and GTD orders for retail clients since 15th of April. Many friends of mine have been asking me about the usefulness of this two functions. I will give my 2 cents here.

Usually for retailers, their validity is by day, which means you queue an order within the market day and it expires. Which means you will have to re queue again when market ends if you want the order queue to be in again the next day.

What GTD and GTM does is basically to carry forward unexecuted orders for a maximum of 30 calender days. GTD lets you specify a day within the 30 days and GTM carries forward until the full 30 days.

Do also note that for GTM/GTD orders, you cannot amend or cancel after market ends. You can only amend or cancel the order the next day at 8.30am onwards.

So whats so impressive you might ask? Well GTM/GTD orders are long dated which means there are never off the market.

If you wish to sell a particular stock at a price target that is hard to be done mainly due the the exorbitant sell queue infront of you, you can use GTM/GTD. As every day after market ends, your queue will not expire and it will be pushed infront of queues that have expired. This usually means that, after a few days, you will find your queue in front of the rest.

A very useful tool to have in my opinion. So do make sure you have a platform that supports these two functions.

QE3 tapering delayed

Please read the disclaimer at the bottom of my blog if you wish to continue with the contents below.

Was pleasantly surprised by the Fed's decision last night to delay tapering. Which means its US$85m monthly bond purchases will be maintained. The best short term scenario I would expect.

Why did the Fed delay tapering of bond purchases?

There might be a few possible reasons, but I would think that the main reason for me is unemployment and inflation. Both are too inverse. Inflation is still very low and employment still very high. There are no signs of reversal for both in near term. Hence it will be quite silly for the Feds to do anything to further worsen the general outlook of the market.

If the general economical outlook shows improvement from now till December(next Fed meeting), perhaps a reduction in the volume of asset purchases will be favored. Until then, we should continue to enjoy a short term bull run. To each his own.

STI surged and hit my target at 3250 and Reits in general appreciated from the news today.

Reits to ride on for the yield pull back

Please read the disclaimer at the bottom of my blog if you wish to continue with the contents below.

I am usually more of a value investor. Current situation calls for a possible pull back of US 10 year yield. This scenario would happen if the up and coming announcement for the tapering of QE3 is superficial/gradual or delayed. A logical thought progression, but still bounded by probability.

This, in my opinion, calls for a potential price appreciation for reit counters. Here are a few fundamentally undervalued counters that I think could be worth the ride(Ignoring those that has already appreciated this past few weeks). I will be willing to hold these medium to long term seeing that they are defensive in nature. To each his own.

SoilbuildBizReit

DPU 4.37cts

Mkt Price: 0.725

Yield: 8.093%

Nav: $0.80

Gearing: 29.90%

AIMSAMPI Reit

DPU 2.5cts

Mkt price: $1.475

Yield: 6.78%

NAV: $1.501

Gearing: 25.40%

Reason: Pure local exposure with discount to book value, decent yield(<6%) and low borrowing.